THE LEADING PRIVATE MONEY LENDER FOR RESIDENTIAL PROPERTIES

FOR INVESTMENT PROPERTIES THAT ARE NON-OWNER-OCCUPIED

TRINDEN FUNDING HARD MONEY LOAN REQUIREMENTS

The foundation of every successful fix-and-flip begins with selecting the right property. That’s why we’ve developed this simple 5-point guide to help you identify the "sweet spot" deal, offering the best chance to profit in real estate while protecting your investment.

At Trinden Funding, we focus on providing hard money loans for projects that offer the highest potential for success. Our criteria are based on 5 key points

WHY THESE CRITERIA?

Homes exceeding the FHA limit are generally more prone to significant value fluctuations and are more vulnerable to both local and broader market depreciation. In contrast, homes within the 5-point range often show greater resilience to these market impacts.

Why Choose 1-4 Units?

This is crucial. Investing within these limits allows you to target a broader portion of the market, including FHA buyers. This helps you attract a wider range of potential buyers from various demographics.

Why price your home at or below FHA limits?

Pricing your home within FHA guidelines makes homeownership more accessible to first-time buyers who may struggle to qualify for conventional loans. This expands your pool of potential buyers and can help your property sell more quickly.

Why opt for a smaller home with no more than 5 bedrooms and 3 baths?

Millennials and Boomers prefer smaller homes—Millennials for affordability, Boomers for downsizing. Buyers now favor modern, compact homes over large, ornate ones.

Why choose less than 1/2 acre?

Boomers and Millennials prefer less upkeep, as more land adds cost and maintenance.

PRIVATE MONEY LENDER FOR YOUR REAL ESTATE FLIP PROJECT

WHAT IS HARD MONEY?

It goes by many names—you’ve likely heard it called 'Private Money,' 'Equity-Based Financing,' 'Bridge Financing,' or 'Creative Financing.' Essentially, they all refer to the same concept. This is non-traditional financing that focuses on the property's value rather than your personal qualifications. These loans are typically secured by a note and deed of trust in the first lien position on the property.

WHO USES HARD MONEY?

It goes by many names—you’ve likely heard it called 'Private Money,' 'Equity-Based Financing,' 'Bridge Financing,' or 'Creative Financing.' Essentially, they all refer to the same concept. This is non-traditional financing that focuses on the property's value rather than your personal qualifications. These loans are typically secured by a note and deed of trust in the first lien position on the property.

STEPS TO SECURING HARD MONEY?

The biggest mistake a real estate investor can make is looking for financing too early, yet this is one of the most common errors we see. The key rule is: it's much easier to secure funding when you have a deal under contract. Why? Until the property is under contract, it’s still available to others, and no lender will invest time or resources on a deal that could be lost at any moment. Getting the property under contract is a straightforward 4-step process.

Step 1: Search and evaluate potential properties

Step 2: Submit offers

Step 3: Secure acceptance of the offer from the seller

Step 4: Deposit earnest money into escrow to finalize the contract

After completing these 4 steps, you’ll have a fully executed Purchase and Sale Agreement, meaning the property is officially under contract, and you’re ready to start seeking financing. If you're at this stage, be sure to fill out the simple Trinden Funding Application to get started.

5 REASONS WHY INVESTORS USE HARD MONEY

Hard Money is often seen as "extremely expensive unless you know how to use it." However, it's much more than that. While Private Money typically costs more than traditional financing, the advantages it offers often make it well worth the price.

It’s Fast: Flipping homes is a time-sensitive business. Depending on how quickly you submit the required loan documents, you can secure funding in a matter of days or weeks. Traditional financing can take one to three months.

It Focuses on Collateral, Not You: Hard money lenders prioritize the value of the property over your credit score, as the property serves as the collateral for the loan.

It’s Widely Available: Hard money lenders are often individuals with funds in lower-yield investments, like CDs or IRAs, looking for higher returns through real estate lending.

It’s Creative: Hard money allows funding for promising properties that need repairs, which banks usually avoid.

It’s Flexible: Hard money lenders aren’t bound by strict guidelines, allowing them to structure loans creatively to suit the project.

Partnering with a Hard Money Lender like Trinden Funding gives you the confidence to secure properties under contract. As long as you find a solid deal that aligns with our guidelines, complete the necessary due diligence, and submit your application, you can trust that your deal will get funded!

FREQUENTLY ASKED QUESTIONS

Yes! It may be used as cross-collateral or used for a cash-out refinance. That is a great strategy! If you have properties that are completely paid for with no liens against them, we can do a cash-out refinance to provide funds for other non-owner occupied investments. You can also use them as cross-collateral for your real estate investing. We use both your subject property and your free and clear property as security for the loan. In doing that, we can lend up to 65% of the as-is combined value of the two properties. That is often enough to purchase your subject property and rehab it. If you have free and clear properties, mention that on your next deal!

Our decision is based on the property, the type of transaction, and your membership in any of our special programs. For most transactions we will lend up to 90% of the purchase price or 65% of the as-is or after-repair appraised value, whichever is less. Ask a loan officer about the special terms available through our membership programs and special purpose loans.

Yes! Ask a loan officer for more information. By providing more than one property as collateral (cross-collateralization), we can offer 100% financing. If you don’t own a free and clear property, consider partnering with someone who does—sharing profits is better than missing out on the deal. Many of our investors also use seller carrybacks for similar results. We recommend securing deals below appraised value as the best way to achieve 100% financing.

Look for people that have a need to sell and get to them before your competitors do. The simple answer is: wherever you have the least competition. The harder they are to find, the less competition you will have, and the better your chances for a good price. It requires work, but it is work that can end in a deal with profit as opposed to work that spins wheels but never gets a profitable deal. For instance: talk to probate or divorce attorneys, find ugly houses, contact out-of-state owners, etc. Be creative!

Yes, for the right deals. If the numbers work and we think the deal will be profitable, we will loan on the After Repair Value (ARV). We recommend you have solid experience doing or managing such repair work. You will need to supply licensed contractor bids as well as meet certain other requirements. Bring us the deal and let’s discuss it.

Our loans are asset-based and our decisions are logic-based. That means we base our decisions about funding and rates on the perceived risk associated with the property. If you have a property under contract, submit it. Our rates are competitive in the private money market but we save our best rates for our best clients. Get started today to become one of those repeat, best clients! Get a property under contract and submit it!

APPLY NOW

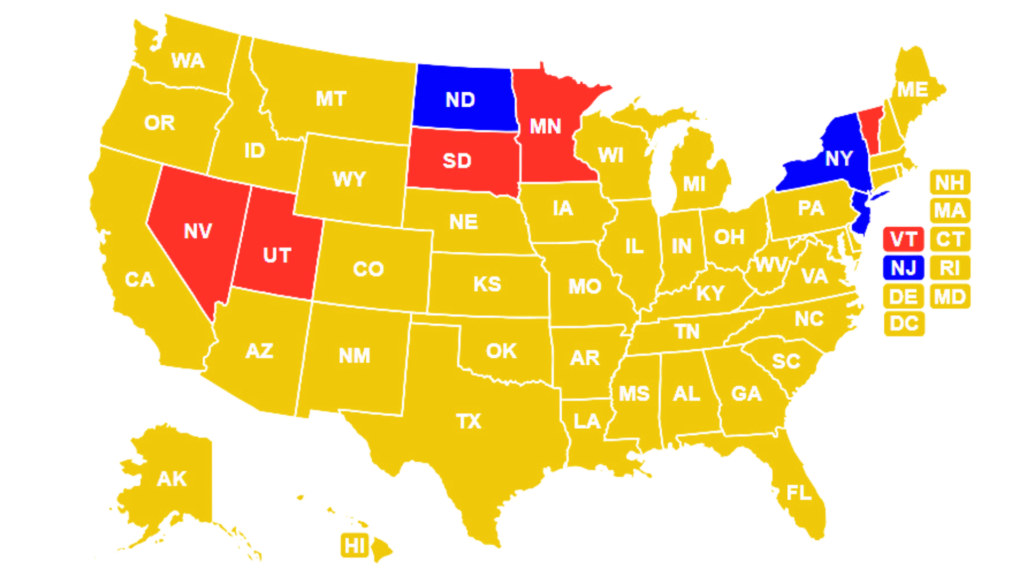

OUR LENDING MARKETS

Trinden Funding is dedicated to providing real estate investors nationwide with fast and dependable funding for their projects. Our residential loans are accessible in many states—keep reading to find out if we're available in your area!

PACIFIC/MTN:

ALASKA

ARIZONA

CALIFORNIA

COLORADO

HAWAII

IDAHO

MONTANA

NEW MEXICO

OREGON

WASHINGTON

WYOMING

CENTRAL:

ALABAMA

ARKANSAS

ILLINOIS

INDIANA

IOWA

KANSAS

LOUISIANA

MISSISSIPPI

MISSOURI

NEBRASKA

NORTH DAKOTA*

OKLAHOMA

TEXAS

WISCONSIN.

NORTHEAST:

CONNECTICUT

NEW YORK*

NEW JERSEY*

NEW HAMPSHIRE

MAINE

MASSACHUSETTS

PENNSYLVANIA

RHODE ISLAND.

SOUTHEAST:

ALABAMA

DELAWARE

FLORIDA

GEORGIA

KENTUCKY

NORTH CAROLINA

SOUTH CAROLINA

TENNESSEE

VIRGINIA

WASHINGTON DC

WEST VIRGINIA

.

*We we don’t lend in red and blue states

Trinden Funding is a private money lender providing innovative financing options for real estate investors through private money loans.